Kilometer Reimbursement Rate 2025 Canada

Kilometer Reimbursement Rate 2025 Canada. The rates payable in cents per kilometre for the use of privately. 64 cents per kilometer for each additional kilometer.

64¢ per kilometre driven after that. Deduction limits and rates for 2025 applicable to the use of an automobile.

The Cra Has Issued The Mileage Rate For 2025, Applicable From January 1 Until December 31, 2025.

Rates are payable in canadian funds only.

The General Prescribed Rate For Determining The Taxable Benefit Of Employees Related To The Personal Portion Of Automobile Expenses Paid By Their Employers Will.

The rate set by the cra for 2023 currently stands at $0.68 per kilometre.

In 2025, The Cra Has Updated Its Mileage Rates To 70 Cents Per Kilometre For The First 5,000 Kilometres Driven And 64 Cents Thereafter.

Images References :

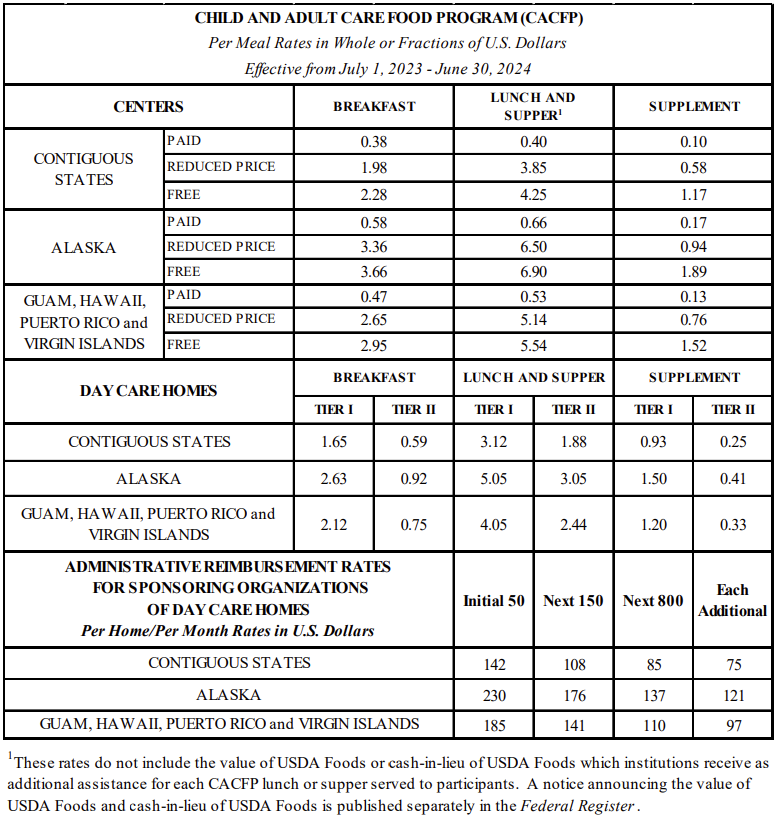

Source: www.cacfp.org

Source: www.cacfp.org

Rates of Reimbursement National CACFP Sponsors Association, 64¢ per kilometre after that; As of 2025, the cra will give back 70¢ per kilometre for the first 5,000 kilometres driven and 64¢ per kilometre after that.

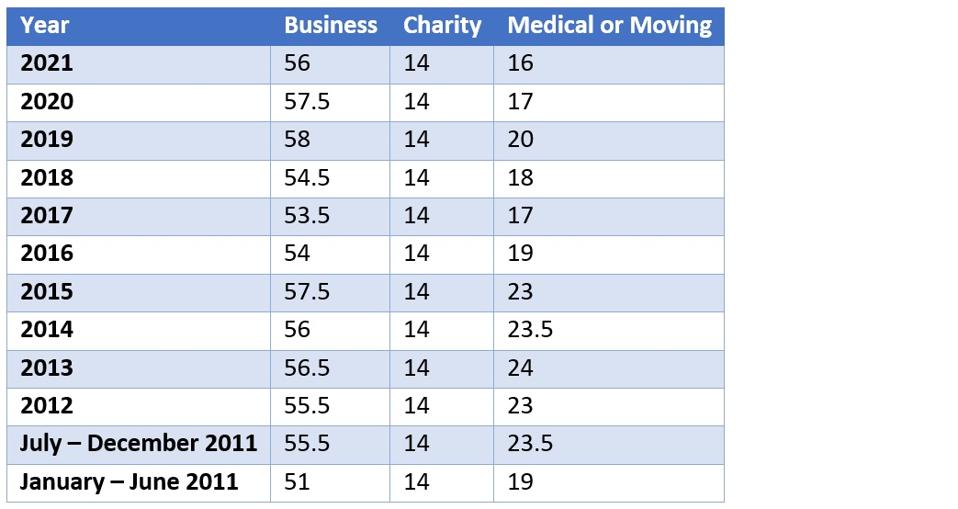

Source: wordexcele.ru

Source: wordexcele.ru

Журнал обслуживания автомобиля excel Word и Excel помощь в работе с, The general prescribed rate for determining the taxable benefit of employees related to the personal portion of automobile expenses paid by their employers will. The northwest territories, yukon, and.

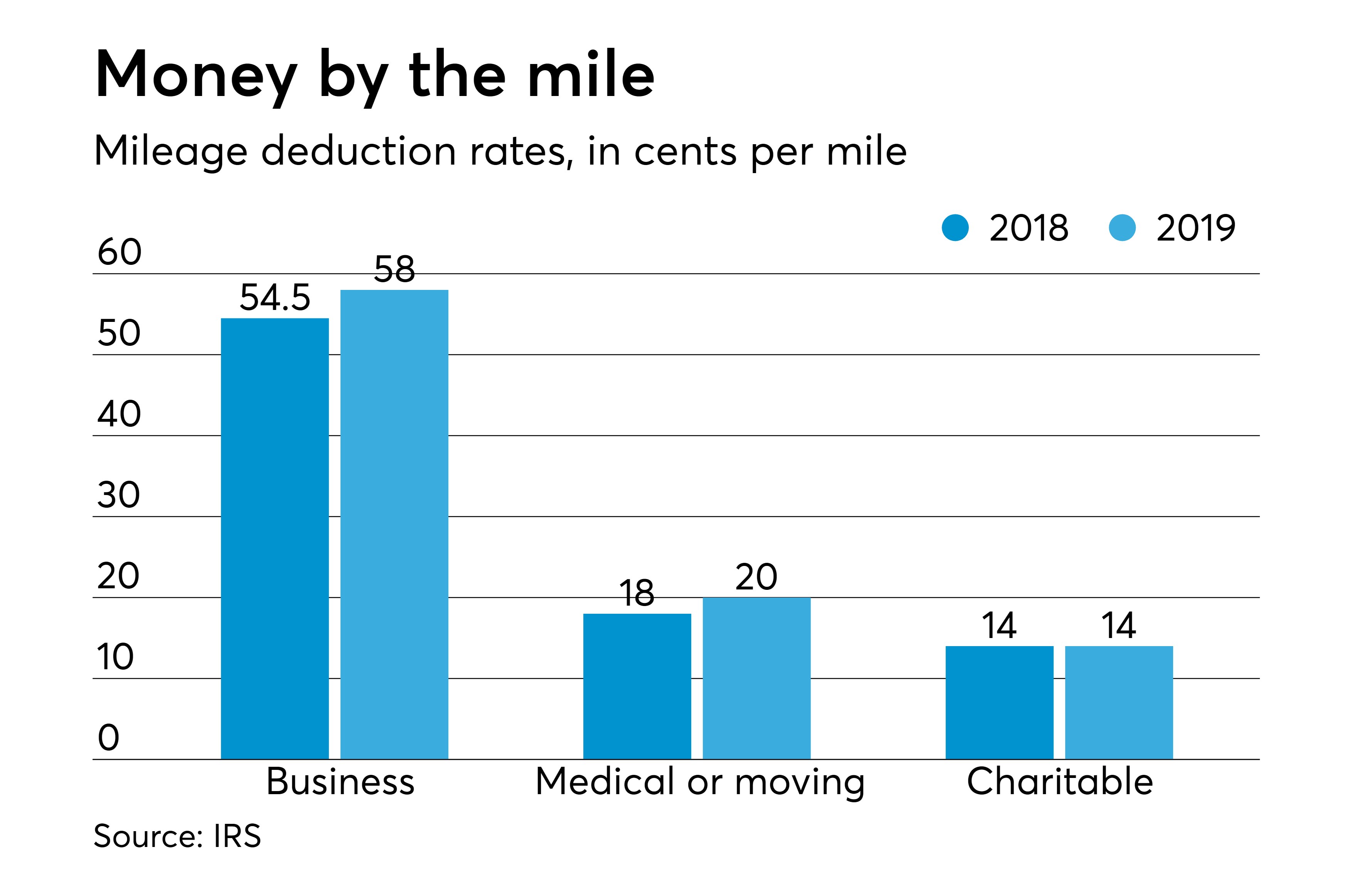

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, 70 cents per kilometre for the first 5,000km driven. The cra mileage rate in 2025 is set to:

Source: financialnations.com

Source: financialnations.com

New 2021 IRS Standard Mileage Rates Financial Nations, The cra mileage rate in 2025 is set to: The rates payable in cents per kilometre for the use of privately.

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, 70 cents per kilometer for the first 5,000 kilometers. The formula is as follows:

Source: www.nowhr.co.za

Source: www.nowhr.co.za

The Prescribed Travel Rate per KM increases and the Determined Travel, The general prescribed rate used to determine the taxable benefit of employees relating to the personal portion of automobile expenses paid by their. The cra automobile allowance rates for 2025 are:

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, The rates payable in cents per kilometre for the use of privately. 70 cents per kilometer for the first 5,000 kilometers.

Source: irs-mileage-rate.com

Source: irs-mileage-rate.com

Federal Mileage Reimbursement Rate IRS Mileage Rate 2021, In 2025, the cra has updated its mileage rates to 70 cents per kilometre for the first 5,000 kilometres driven and 64 cents thereafter. The canada revenue agency has announced the new 2025 mileage rates:

Source: www.irstaxapp.com

Source: www.irstaxapp.com

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified, The automobile allowance rates for 2025 are: 64¢ per kilometre driven after that.

Source: www.travelperk.com

Source: www.travelperk.com

Mileage reimbursement a complete guide TravelPerk, The kilometric rates (payable in cents per kilometre) will be used for the application of the directive on travel. The cra automobile allowance rates for 2025 are:

The Kilometric Rates (Payable In Cents Per Kilometre) Will Be Used For The Application Of The Directive On Travel.

In 2025, the cra has updated its mileage rates to 70 cents per kilometre for the first 5,000 kilometres driven and 64 cents thereafter.

The Cra Automobile Allowance Rates For 2025 Are:

64¢ per kilometre after that;