Portugal Vat Rate 2024

Portugal Vat Rate 2024. The portuguese tax authority has issued circular letter 25018/2024 of 10 january 2024, providing an overview of the vat changes introduced by the budget law. Notable changes include adjustments to vat legislation, such as the application of a reduced rate (6%) to specific items, the introduction of a medium rate (13%) for.

A standard rate of 23% applies, together with an. Supply of services are subject to vat in portugal if the acquirer is:

About €20 Tax On A €100 Purchase.

As from 1.1.2024, essential foods will go back to be taxed at the reduced vat rate (6% for mainland portugal, 5% for madeira and 4% for azores).

For Businesses Based In Portugal, The Vat Registration Threshold Is €13,500.

The zero vat rate will apply both for.

Pwc 2024 Tax Guide, For Companies And Individuals, Updated On A Regular Basis.

Images References :

Source: taxology.co

Source: taxology.co

VAT Portugal 2024 Taxology, The vat is a sales tax that applies. Vat compliance and reporting rules in portugal 2024.

Source: www.vatcalc.com

Source: www.vatcalc.com

Portugal VAT country guide 2024, The portuguese tax authority has issued circular letter 25018/2024 of 10 january 2024, providing an overview of the vat changes introduced by the budget law. Last reviewed 16 february 2024

Source: pt.icalculator.com

Source: pt.icalculator.com

Portugal VAT Calculator Portugal VAT Rates in 2024, The zero vat rate will apply both for. 11.9% (for the first € 50,000 of taxable income) 14.7% (for the remainder taxable income) 11.9% (for the first € 50,000 of taxable income) 14.7% (for the remainder taxable.

Source: www.lawyers-portugal.com

Source: www.lawyers-portugal.com

VAT Registration in Portugal Updated for 2024, You can calculate your vat online for standard and specialist goods, line by line to. The standard vat rate in portugal stands at 23 percent.

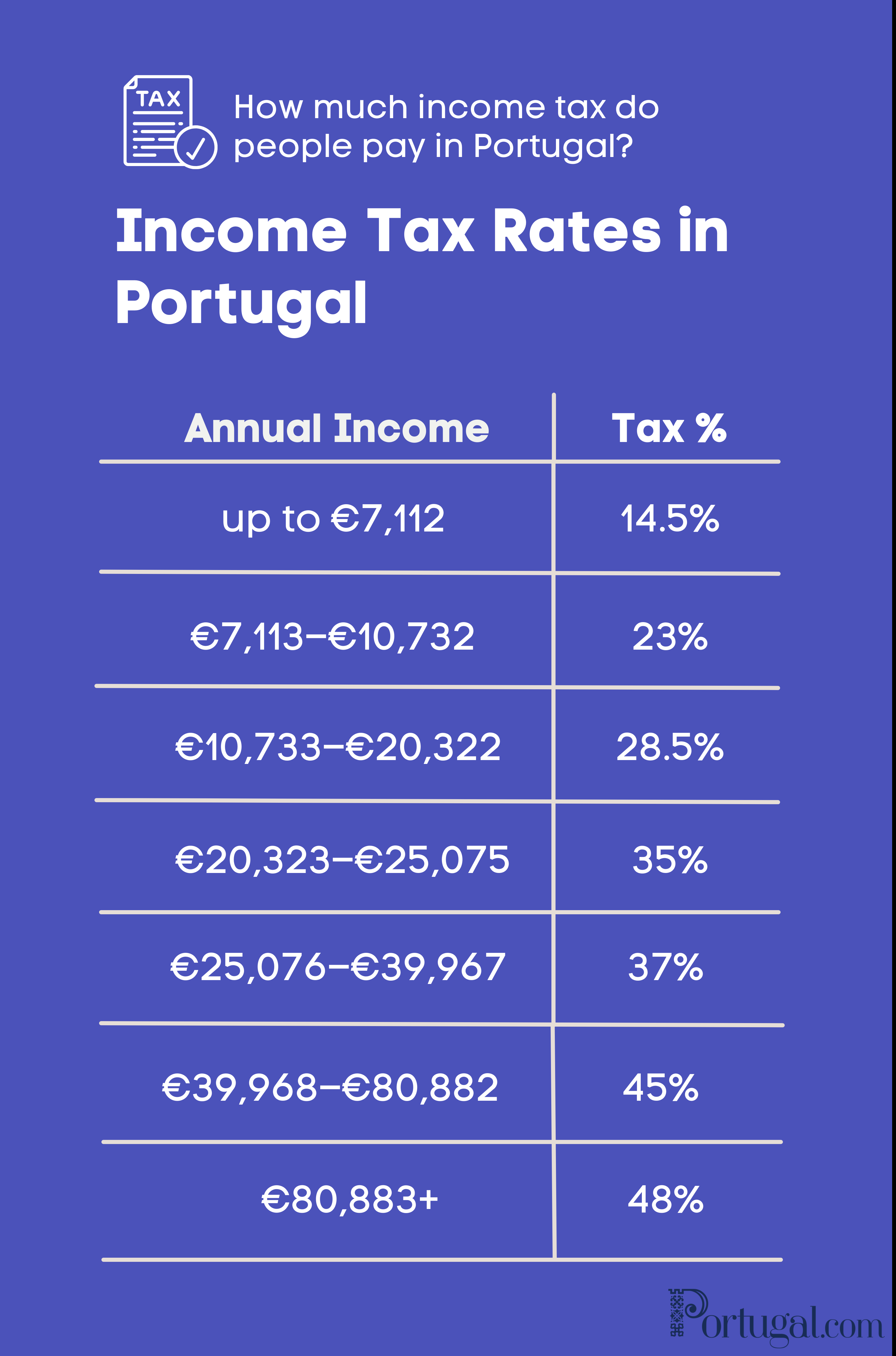

Source: www.portugal.com

Source: www.portugal.com

Expat Guide to Working in Portugal, This is part of a phased increase, with the threshold rising to. The portugal vat calculator is updated with the 2024 portugal vat rates and thresholds.

Source: hellotax.com

Source: hellotax.com

VAT rates in Europe Definition, Actual ValueAddedTax Rates hellotax, 13 of the vat code). Below is summary of the major rules provided under portuguese vat rules (mervärdesskattelagen 1994, vat act;

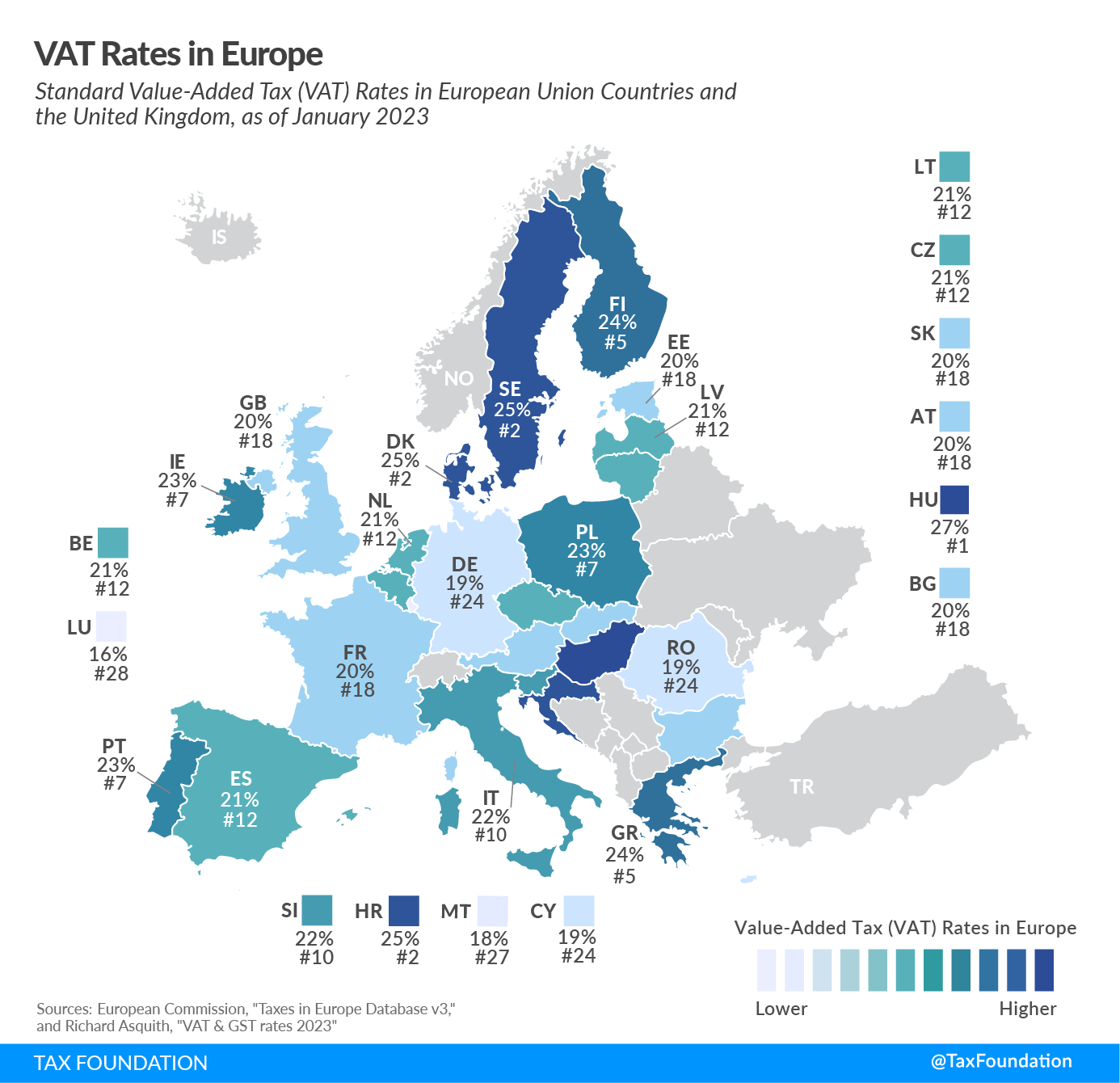

Source: taxfoundation.org

Source: taxfoundation.org

Value Added Tax Rates (VAT) By Country Tax Foundation, Exact tax amount may vary for different items. Supply of services are subject to vat in portugal if the acquirer is:

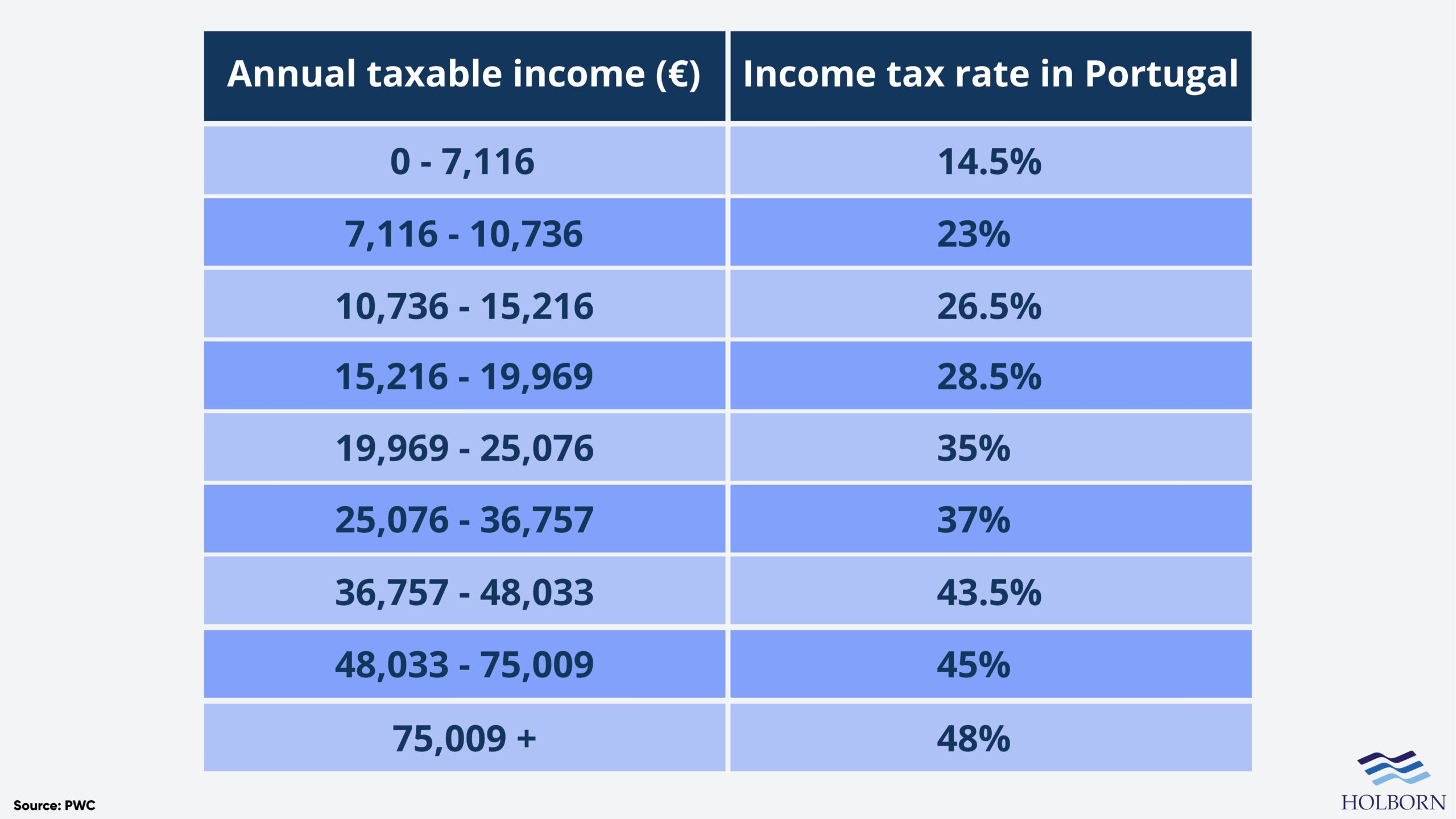

Source: holbornassets.pt

Source: holbornassets.pt

Moving to Portugal from the UAE What you should know Holborn Assets, About €20 tax on a €100 purchase. As from 1.1.2024, essential foods will go back to be taxed at the reduced vat rate (6% for mainland portugal, 5% for madeira and 4% for azores).

Source: www.lawyers-portugal.com

Source: www.lawyers-portugal.com

VAT in Portugal, 11.9% (for the first € 50,000 of taxable income) 14.7% (for the remainder taxable income) 11.9% (for the first € 50,000 of taxable income) 14.7% (for the remainder taxable. The standard vat rate in portugal stands at 23 percent.

Source: www.youtube.com

Source: www.youtube.com

How to obtain the VAT exemption on my purchases in Portugal YouTube, Vat compliance and reporting rules in portugal 2024. For businesses based in portugal, the vat registration threshold is €13,500.

The Zero Vat Rate Will Apply Both For.

Vat compliance and reporting rules in portugal 2024.

Botanical Gardens And Aquariums (That Are Not Exempt Under Article 9 No.

ᐅ last reviewed 20 january 2024.