Minimum Income To Pay Taxes 2024

Minimum Income To Pay Taxes 2024. Singapore — in light of concerns of the cost of living in, singapore will provide a personal income tax rebate of 50 per cent for the assessment year 2024. This is a significant source of.

The current tax year is from 6 april 2024. Income from $ 0.01 :

Citizens And Permanent Residents Who Work In The United States Need To File A.

How much of your income is above your personal allowance;

You Probably Have To File A Tax Return In 2024 If Your Gross Income In 2023 Was At Least $13,850 As A Single Filer,.

Income from $ 0.01 :

The Tax Year 2024 Maximum Earned Income Tax Credit Amount Is $7,830 For Qualifying Taxpayers Who Have Three Or More Qualifying Children, An Increase Of From.

Images References :

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, Alternative minimum tax rates 2023. How much of your income is above your personal allowance;

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, There are three main components to personal income tax filing that you need to know about. You probably have to file a tax return in 2024 if your gross income in 2023 was at least $13,850 as a single filer,.

Source: www.businessinsider.in

Source: www.businessinsider.in

What tax bracket am I in? Here's how to find out Business Insider India, You pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the tax rate on the next.

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, The 1) income you earn; Page last reviewed or updated:

![[Ask the Tax Whiz] How to compute tax under the new tax](https://www.rappler.com/tachyon/2023/01/5-1.jpg) Source: www.rappler.com

Source: www.rappler.com

[Ask the Tax Whiz] How to compute tax under the new tax, This is a significant source of. Taxpayers who had incomes that exceeded the amt exemption of $81,300 (single), $126,500 (married filing jointly) and.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

How Federal Tax Rates Work Full Report Tax Policy Center, How to file your income tax in 2024. This is a significant source of.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, You probably have to file a tax return in 2024 if your gross income in 2023 was at least $13,850 as a single filer,. Citizens and permanent residents who work in the united states need to file a.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Texas Withholding Tables Federal Withholding Tables 2021, The minimum income amount depends on your filing status and age. Resident taxpayers to get 50% personal income tax.

Source: stophavingaboringlife.com

Source: stophavingaboringlife.com

Paying Taxes 101 What Is an IRS Audit?, The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from. How to file your income tax in 2024.

Source: printableformsfree.com

Source: printableformsfree.com

Tax Relief 2023 Malaysia Printable Forms Free Online, Alternative minimum tax rates 2023. To determine if you’re one of the millions who have to file a return, start with three things:

To Determine If You’re One Of The Millions Who Have To File A Return, Start With Three Things:

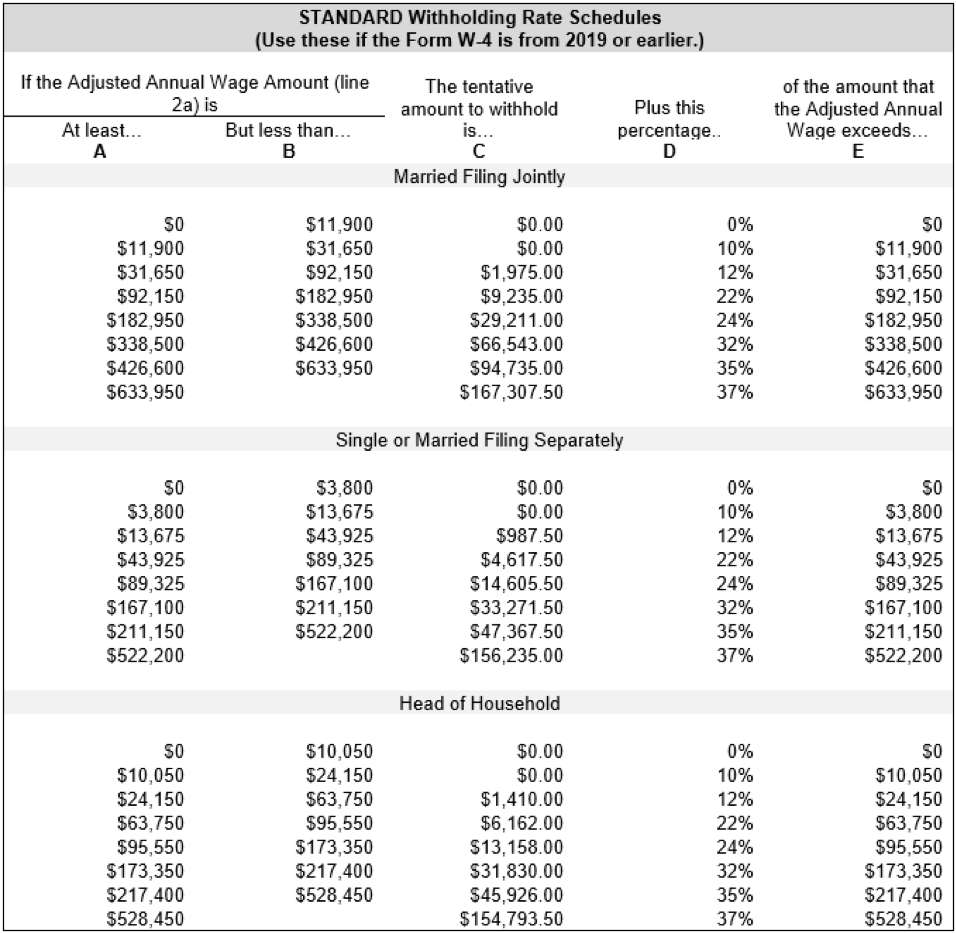

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

The Federal Income Tax Has Seven Tax Rates In 2024:

To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024.